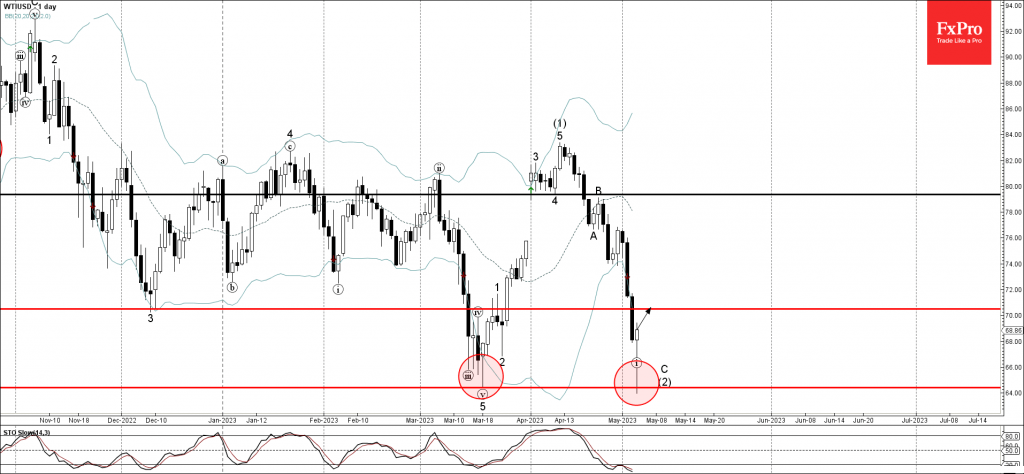

• WTI reversed from key support level 64.40

• Likely to rise to resistance level 70.00.

WTI crude oil recently reversed up from the key support level 64.40 (previous monthly low from March) standing well below the lower daily Bollinger Band.

The upward reversal from the support level 64.40 is currently forming the daily Japanese candlesticks reversal pattern Hammer.

Given the oversold daily Stochastic, WTI crude oil can be expected to rise further toward the next round resistance level 70.00.