– WTI broke resistance level 81.10

– Likely to rise to resistance level 86.00

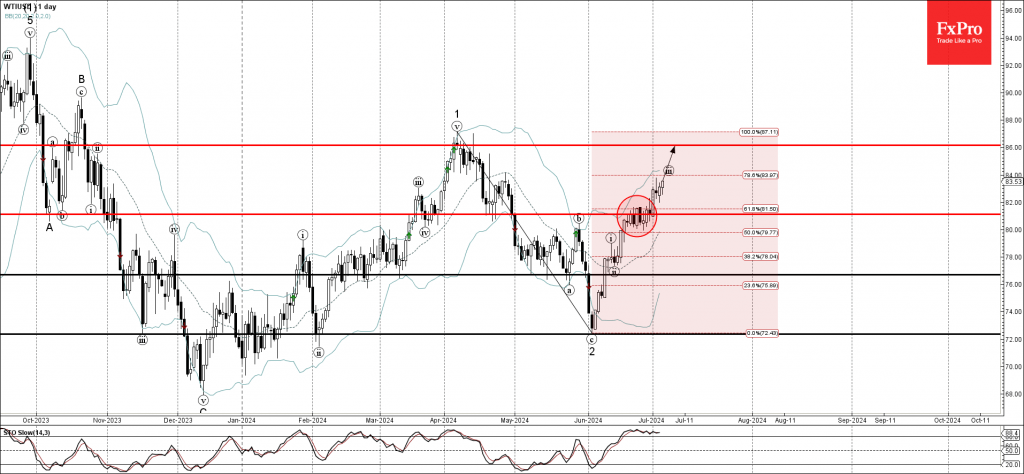

WTI crude oil recently broke the resistance level 81.10 (former top of the minor correction (b) from the end of May).

The breakout of the resistance level 81.10 coincided with the breakout of the 61.8% Fibonacci correction of the previous sharp ABC correction 2 from the start of April.

WTI crude oil can be expected to rise further toward the next resistance level 86.00, former strong resistance from April and the target price for the completion of the active impulse wave (iii).