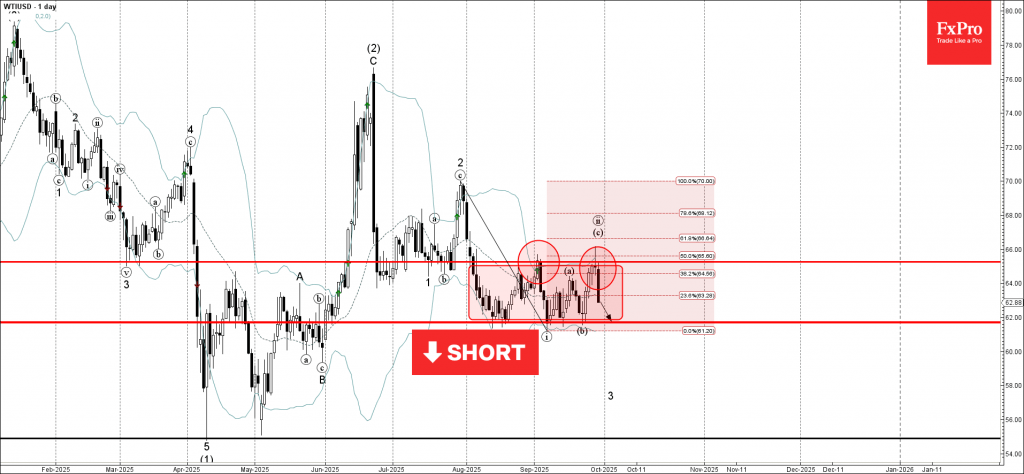

WTI: ⬇️ Sell

– WTI reversed from resistance level 65.25

– Likely to fall to support level 61.70

WTI crude oil recently reversed down from the the resistance area between the resistance level 65.25 (upper border of the active sideways price range from the start of August).

The resistance level 65.25 was strengthened by the upper daily Bollinger Band and by the 50% Fibonacci correction of the downward impulse from the end of July.

WTI crude oil can be expected to fall to the next support level 61.70 (lower border of the active sideways price range).