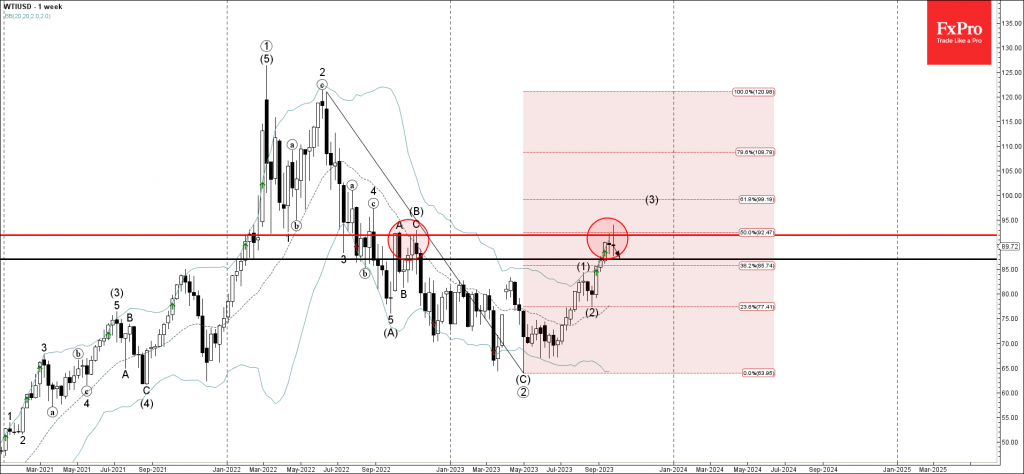

– WTI reversed from resistance level 92.00

– Likely to fall to support level 87.00

WTI crude oil earlier reversed down from the pivotal resistance level 92.00 (which reversed the price strongly at the end of 2022) intersecting with the upper weekly Bollinger Band and the 50% Fibonacci correction of the downtrend from the middle of the last tear.

The downward reversal from the resistance level 92.00 will create the second consecutive weekly candlesticks reversal pattern Doji – signalling the strength of the resistance level 92.00.

Given the strength of the resistance level 92.00, WTI crude oil can be expected to fall further toward the next support level 87.00.