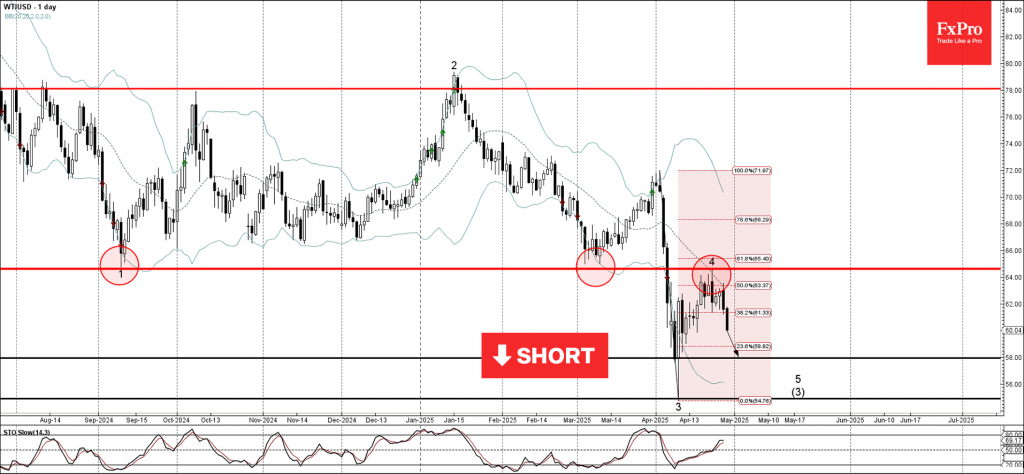

WTI: ⬇️ Sell

– WTI reversed from the resistance area

– Likely to fall to support level 58.00

WTI crude oil recently reversed from the resistance area between the resistance level 64.60 (former multi-month low from September 2024), the 20-day moving average and the 61.8% Fibonacci correction of the downward impulse from the start of April.

The downward reversal from this resistance started the active short-term impulse wave 5, which belongs to the intermediate impulse sequence from last year.

Given the clear daily uptrend, WTI crude oil can be expected to fall toward the next support level 58.00.