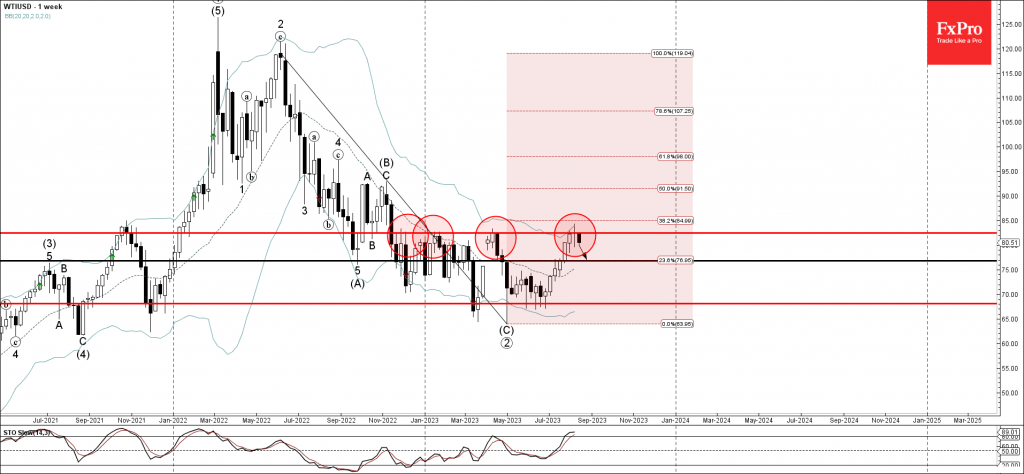

– WTI reversed from resistance level 82.50

– Likely to fall to support level 76.80.

WTI crude oil recently reversed down from the major long-term resistance level 82.50 (which has been reversing the price from the end of last year).

The resistance level 82.50 was strengthened by the upper daily Bollinger Band and the 38.2% Fibonacci correction of the previous downtrend from last year. Given the strength of the resistance level 82.50 and the overbought weekly Stochastic, WTI crude oil can be expected to fall further toward the next support level 76.80