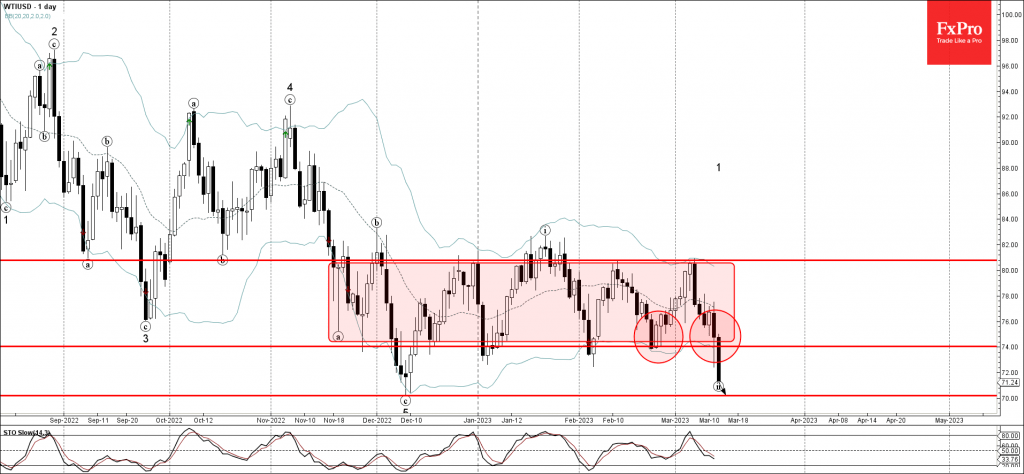

• WTI broke key support level 74.00

• Likely to fall to support level 70.20

WTI crude oil under the bearish pressure after the earlier breakout of the key support level 74.00 (which is the lower boundary of the sideways price range from the middle of November).

The breakout of the support level 74.00 accelerated the active corrective wave (ii).

WTI crude oil can be expected to fall further toward the next support level 70.20 (former multi-month low from February, target for the completion of the active wave (ii)) – from where the upward correction is likely.