– WTI reversed from support level 68.00

– Likely to rise to resistance level 73.35

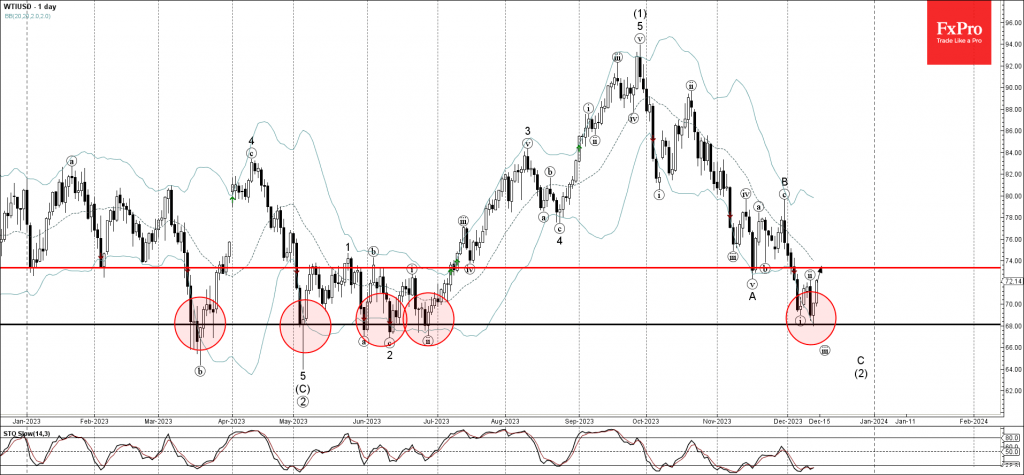

WTI crude oil recently reversed up from the major long-term support 68.00 (which has been repeatedly reversing the price from March) coinciding with the lower daily Bollinger Band.

The upward reversal from the support 68.00 is likely to form the daily candlesticks reversal pattern Morning Star – strong buy signal for this instrument.

Given the strength of the support 68.00 and the oversold daily Stochastic, WTI crude oil can be expected to rise to the next resistance level 73.35 (former support from November).