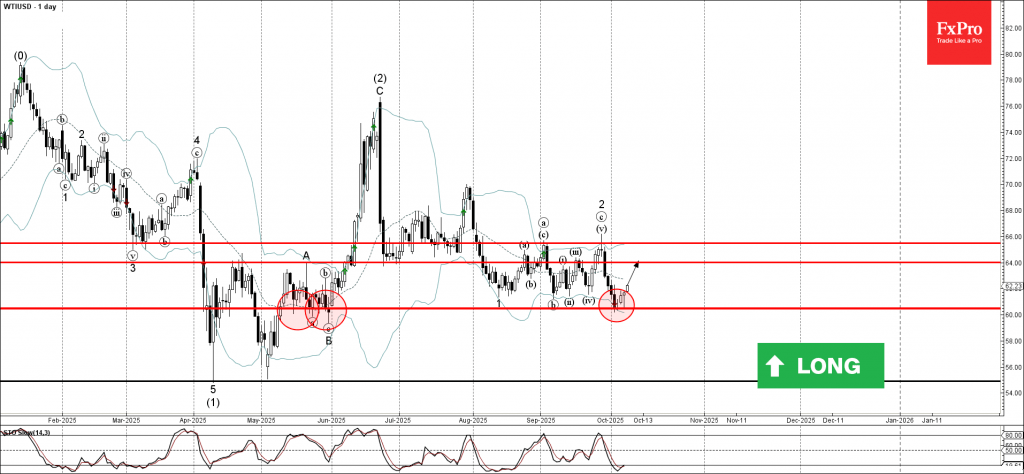

WTI crude oil: ⬆️ Buy

– WTI crude oil reversed from round support level 60.00

– Likely to rise to resistance level 64.00

WTI crude oil recently reversed up from the support zone surrounding the round support level 60.00 (which has been reversing the price from the middle of May).

The upward reversal from the support level 60.00 created the daily Japanese candlesticks reversal pattern Hammer.

Given the strength of the nearby support level 60.00 and the oversold daily Stochastic, WTI crude oil can be expected to rise to the next resistance level 64.00.