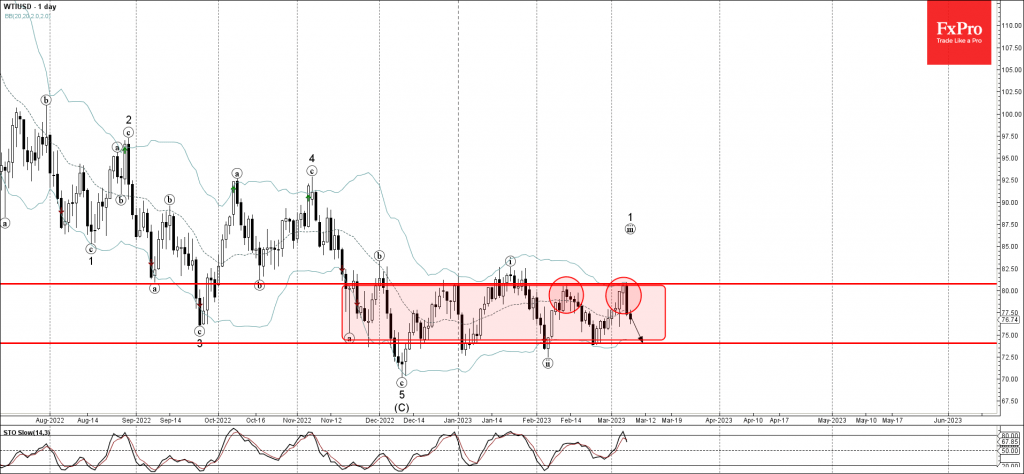

• WTI reversed from resistance level 80.80

• Likely to fall to support level 74.00

WTI crude oil recently reversed down from the resistance level 80.80 (upper border of the sideways price range inside which the price has been moving from November) – coinciding with the upper daily Bollinger Band.

The downward reversal from the resistance level 80.80 created the daily Japanese candlesticks reversal pattern Evening Star.

Given the strong daily downtrend, WTI crude oil can be expected to fall further to the next support level 74.00 (which has been reversing the price from December).