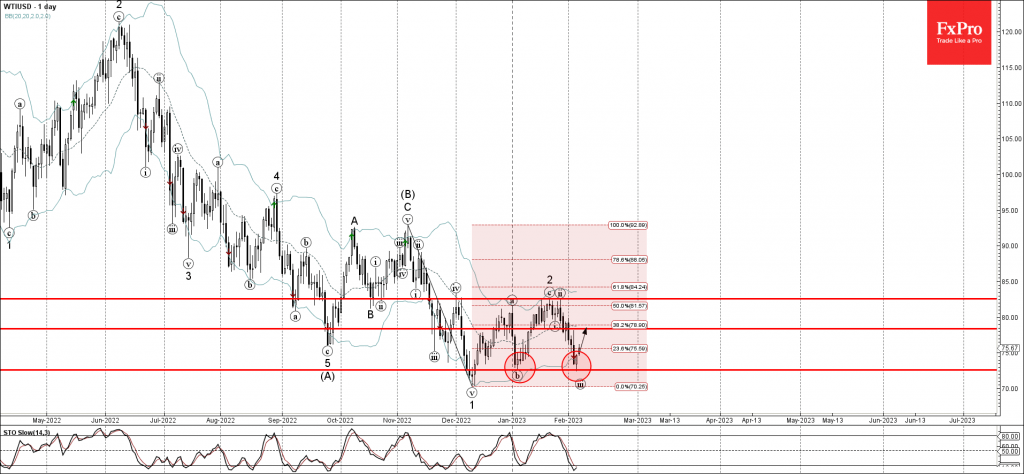

• WTI crude oil reversed from support level 72.50

• Likely to rise to resistance level 78.40

WTI crude oil recently reversed up from the key support level 72.50, which stopped the previous minor correction (b) from the start of January.

The upward reversal from the support level 72.50 stopped the previous short-term impulse wave (iii).

Given the oversold daily Stochastic, WTI crude oil can be expected to rise further toward the next resistance level 78.40.