– WTI crude oil broke resistance area

– Likely to rise to resistance level 76.00

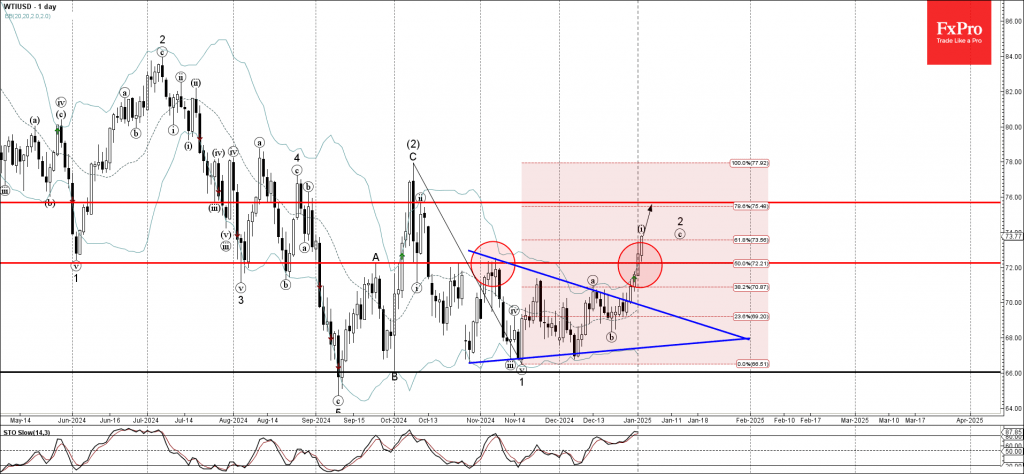

WTI crude oil rising sharply after the earlier breakout of the resistance area located between the key resistance level 72.25 (top of the previously broken daily Triangle) and the 50% Fibonacci correction of the previous downward impulse 1 from October.

The breakout of the resistance area accelerated the c-wave of the active ABC correction 2 from the middle of November.

WTI crude oil can be expected to rise to the next round resistance level 76.00 (former resistance from October and the target price for the completion of the active wave 2).