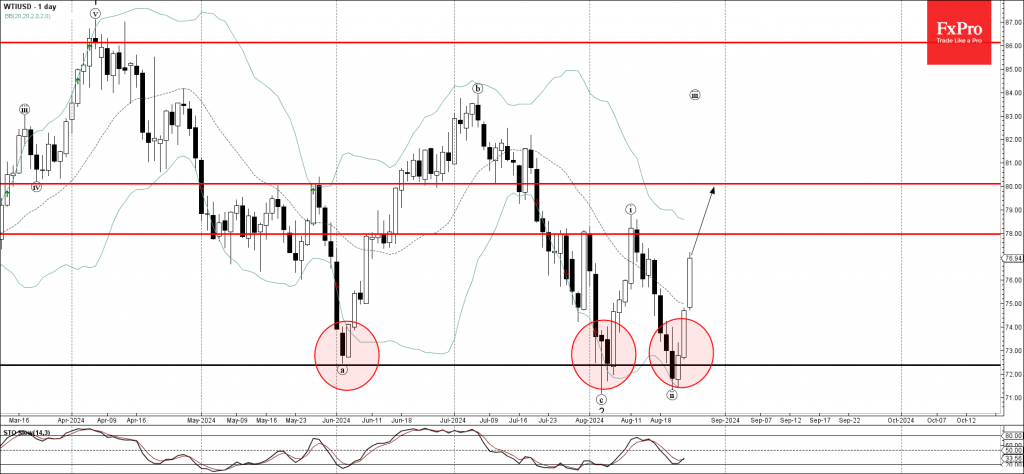

– WTI crude oil reversed from a strong support level 72.40

– Likely to rise to resistance level 78.00

WTI crude oil recently reversed up from the strong support level 72.40 (which has been reversing the price from the start of June) coinciding with the lower daily Bollinger Band.

The upward reversal from the support level 72.40 created the daily candlesticks reversal pattern Piercing Line which started the active impulse wave iii.

Given the strength of the active impulse wave iii, WTI crude oil can then be expected to rise to the next resistance level 78.00 – followed by 80.00.