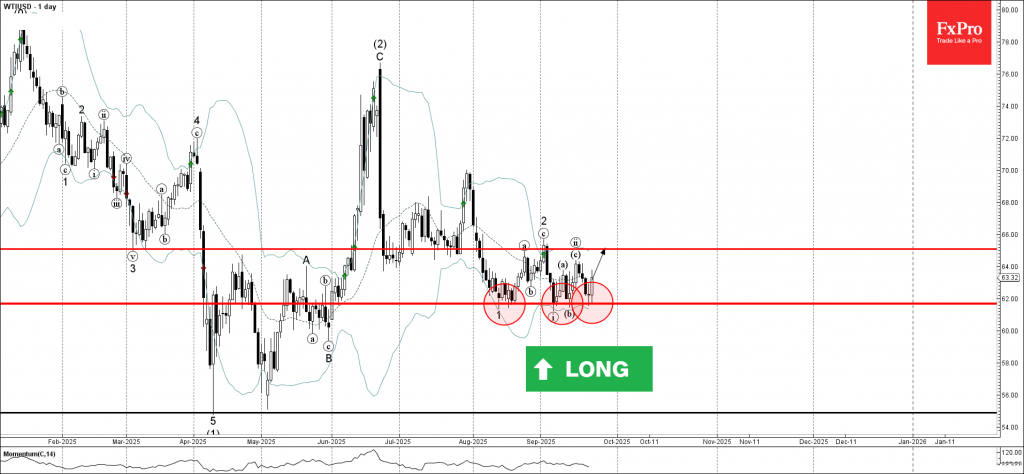

WTI crude oil: ⬆️ Buy

– WTI crude oil reversed up from the key support level 61.70

– Likely to rise to resistance level 65.00

WTI crude oil recently reversed up from the key support level 61.70 (which has been reversing the price from the start of August) intersecting with the lower daily Bollinger Band.

The upward reversal from the support level 61.70 will most likely form the daily Japanese candlesticks reversal pattern Morning Star – if the price closes today near the current levels.

Given the strength of the support level 61.70, WTI crude oil can be expected to rise to the next resistance level 65.00 (which stopped earlier waves a, 2 and ii).