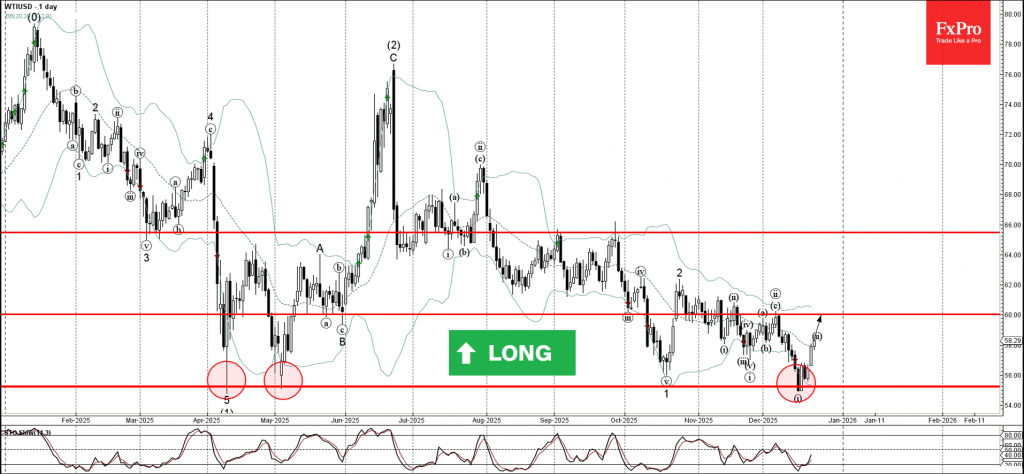

WTI crude oil: ⬆️ Buy

– WTI reversed from strong support level

– Likely to rise to resistance level 60.00

WTI crude oil recently reversed up from the support area between the strong support level 55.20 (former monthly low from April and May) and the lower daily Bollinger Band.

The upward reversal from this support area created the daily Japanese candlesticks reversal pattern Bullish Engulfing – which started the active short-term correction ii.

Given the strength of the support level 55.20, WTI crude oil can be expected to rise to the next resistance level 60.00 (top of the previous wave ii).