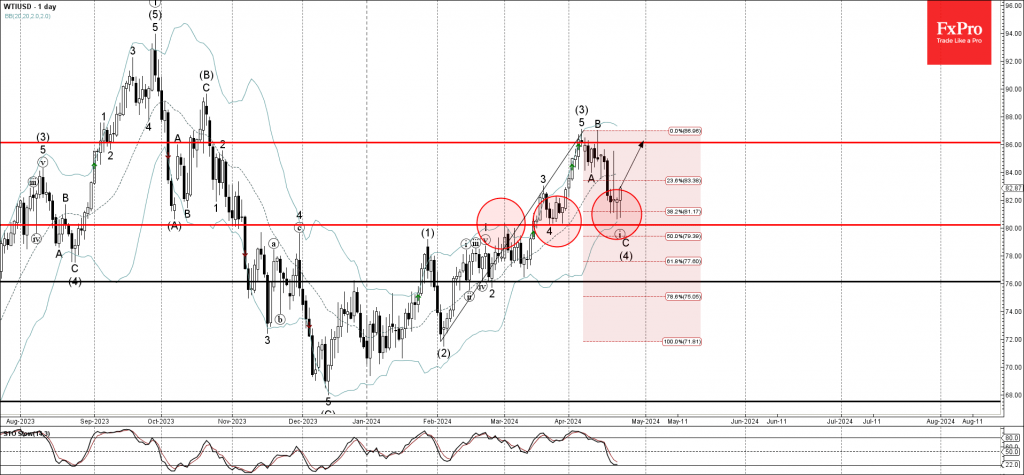

– WTI crude oil reversed from support zone

– Likely to rise to resistance level 86.00

WTI crude oil recently reversed up from the support zone lying between the round support level 80.00 (low of wave (iv) from March), lower daily Bollinger Band and the 38.2% Fibonacci correction of the upward impulse from February.

The upward reversal from the support level 80.00 stopped the previous ABC correction (4) – forming the daily Hammer.

Give the strength of the support level 80.00, WTI crude oil can be expected to rise further to the next resistance level 86.00 (which stopped waves (3) and B).