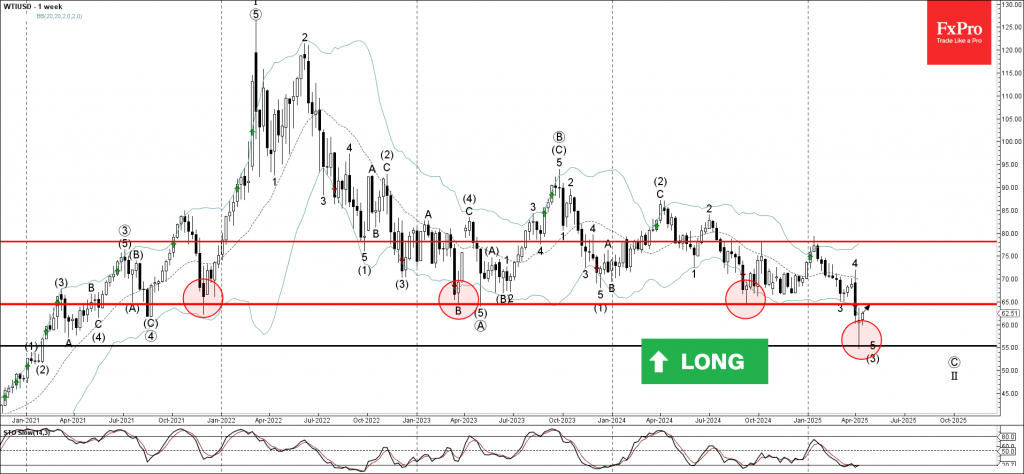

WTI crude oil: ⬆️ Buy

– WTI crude oil reversed from key support level 55,00

– Likely to rise to resistance level 65.00

WTI crude oil recently reversed up from the key support level 55,00 standing close to the lower daily and the weekly Bollinger Bands.

The upward reversal from this support level created the weekly Japanese candlesticks reversal pattern long-legged Doji which stopped the previous impulse waves 5 and (3).

Given the strength of the support level 55,00, WTI crude oil can be expected to rise to the next resistance level 65.00 (former multiyear support level, acting as the resistance after it was broken earlier).