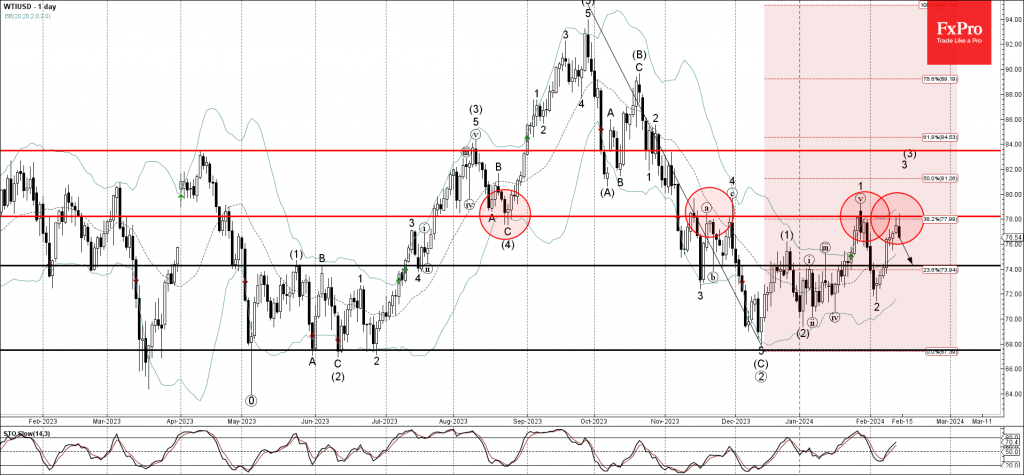

– WTI crude oil reversed from resistance level 78.00

– Likely to fall to support level 74.00

WTI crude oil recently reversed down from the pivotal resistance level 78.00 (former support from August, which has been reversing the price from November), intersecting with by the upper daily Bollinger Band and the 38.2% Fibonacci correction of the downward impulse from September.

The downward reversal from the resistance level 78.00 stopped the previous impulse waves 3 and (3).

Given the improvement of the global risk sentiment, WTI crude oil can be expected to fall further to the next support level 74.00.