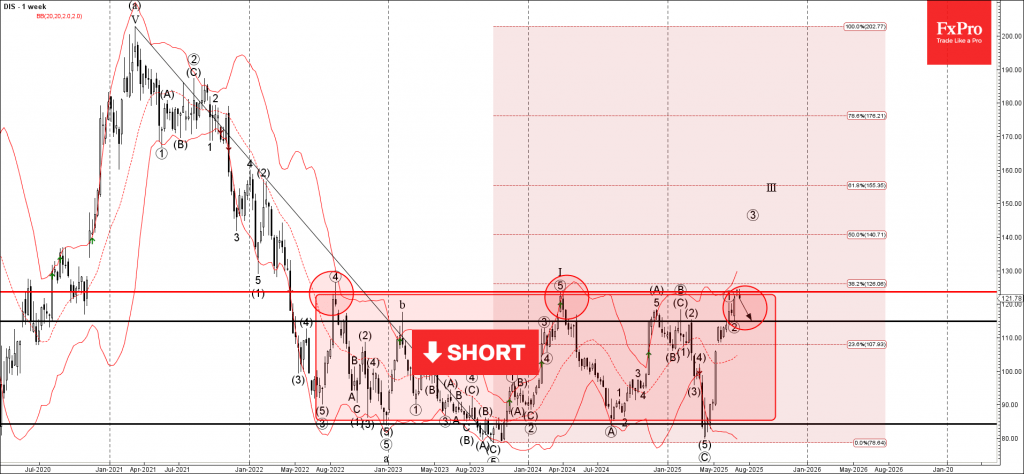

Disney: ⬇️ Sell

– Disney reversed from multi-month resistance level 123.60

– Likely to fall to support level 114.90

Disney recently reversed from the strong multi-month resistance level 123.60 (which is the upper border of the sideways price range inside which the price has been trading from 2022) standing near the upper weekly Bollinger Band.

The resistance level 123.60 was further strengthened by the 38.2% Fibonacci correction of the sharp weekly downtrend from the start of 2021.

Disney can be expected to fall to the next support level 114.90 (former low of the primary correction 2 from May).