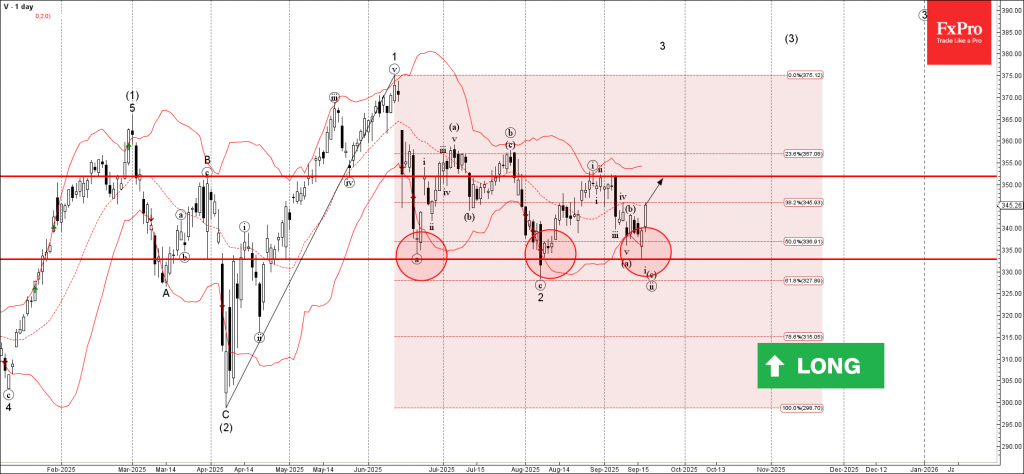

Visa: ⬆️ Buy

– Visa reversed from key support level 333.00

– Likely to rise to resistance level 351.20

Visa recently reversed down from the support area between the key support level 333.00 (which has been reversing the price from June), lower daily Bollinger Band and the 50% Fibonacci correction of the upward impulse 1 from April.

The upward reversal from this support area stopped the c-wave of the previous ABC correction ii from the end of August.

Given the strength of the support level 333.00, Visa can be expected to rise to the next resistance level 351.20 (top of wave i from the end of August).