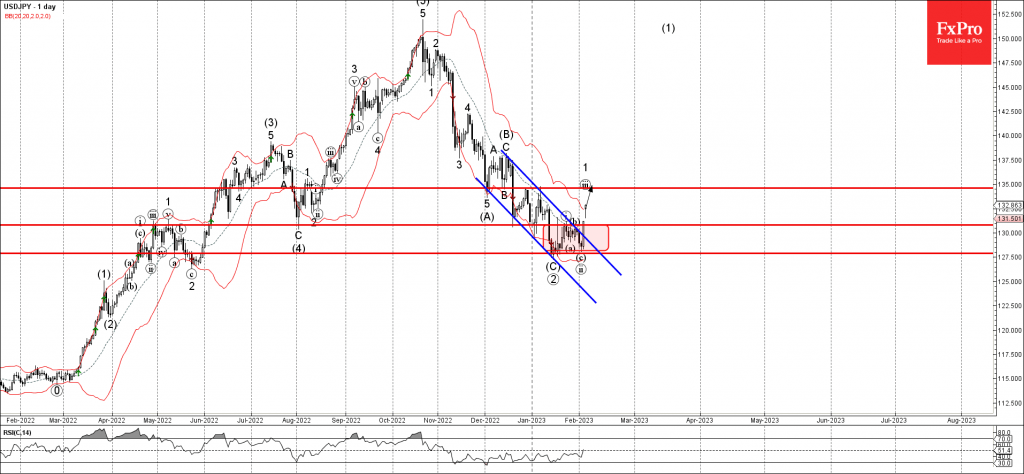

• USDJPY broke resistance level 130.80

• Likely to rise to resistance level 135.00

USDJPY recently broke sharply above the resistance level 130.80, which is the upper boundary of the sideways price range inside with the pair has been trading from January.

The breakout of this sideways price range was preceded by the breakout of the daily down channel from December – which accelerated the active impulse wave 1.

USDJPY can be expected to rise further toward the next resistance level 135.00 (target for the completion of the active impulse wave 1).