– USDJPY broke key resistance level 150.85

– Likely to rise to resistance level 151.90

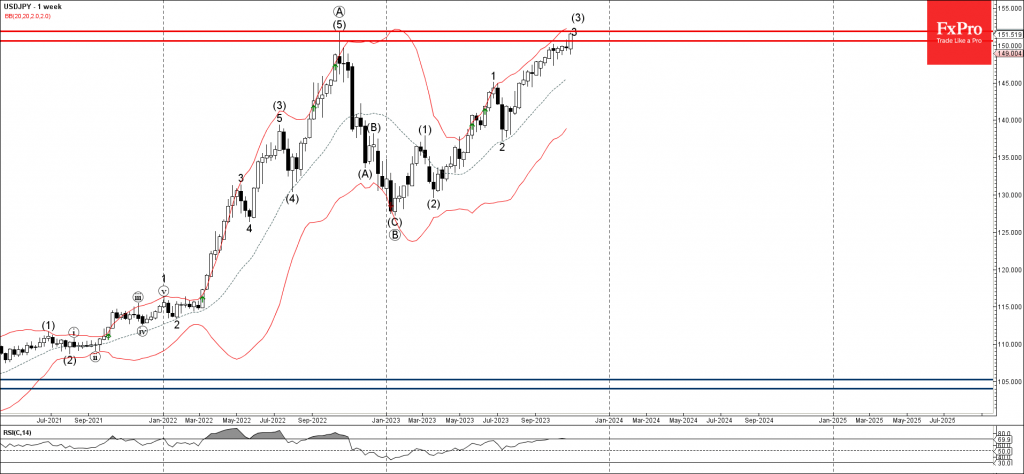

USDJPY recently broke the key resistance level 150.85 (top of the previous daily Evening Star reversal pattern from last week).

The breakout of the resistance level 150.85 accelerated the active medium-term impulse wave (3) from the March.

Given the clear weekly and daily uptrend, USDJPY can be expected to rise further toward the next resistance level 151.90 (which stopped the weekly uptrend in 2022) – from where the downward correction is likely.