– USDJPY broke key resistance level 155.00

– Likely to rise to resistance level 160.00

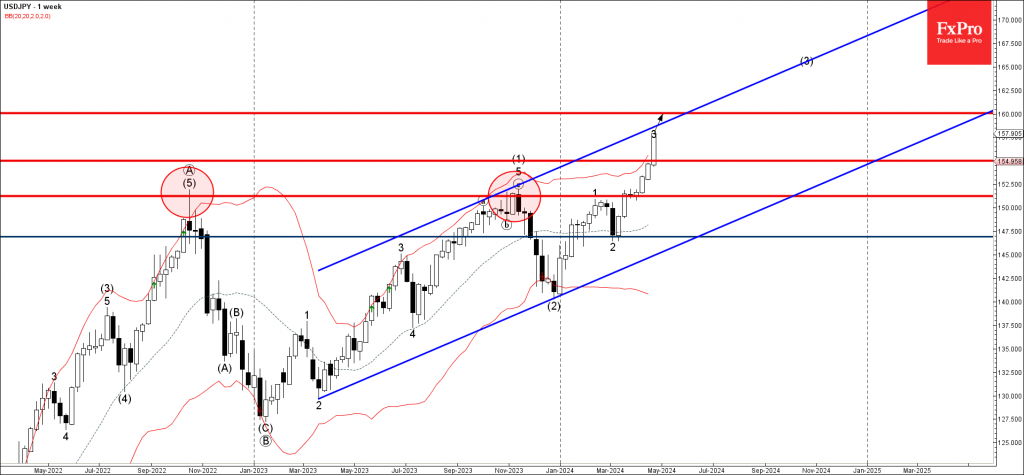

USDJPY currency pair recently broke the key resistance level 155.00, which led to the acceleration of the active impulse waves 3 and (3).

The pair earlier broke the major resistance level 151.25 (which has been reversing the pair from 2022) – which was taken as the major buy signal by the FX traders.

Give the strongly bearish yen sentiment, USDJPY currency pair can be expected to rise further to the next resistance level 160.00, target for the completion of wave 3.