– USDJPY reversed from the support area

– Likely to rise to the resistance level 150.95

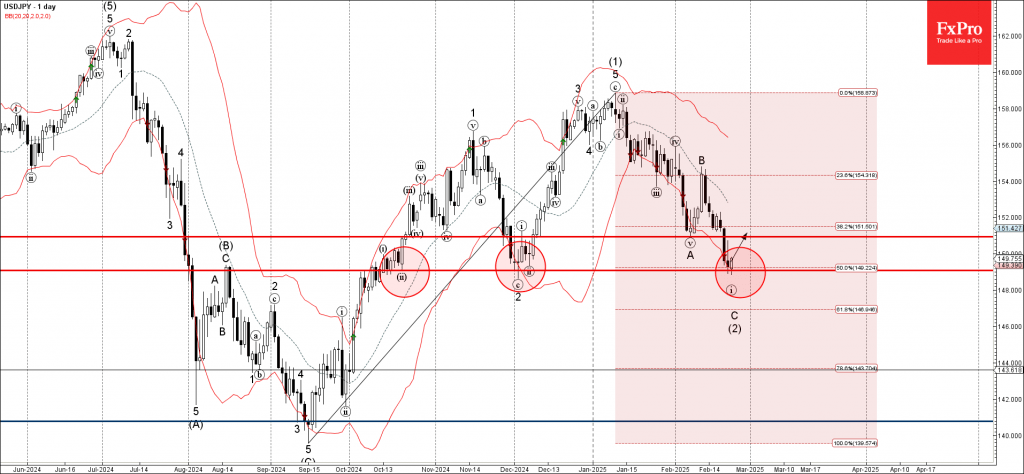

USDJPY currency pair previously reversed up from the support area set between the support level 149.00 (which has been reversing the price from October), 50% Fibonacci retracement of the upward impulse (1) from September and the lower daily Bollinger Band.

The upward reversal from this support area stopped the C-wave of the previous ABC correction (2) from the start of January.

Given the rising bearish yen sentiment seen across the FX markets today, USDJPY currency pair can be expected to rise to the next resistance level 150.95 (the former low of wave A from the start of February).