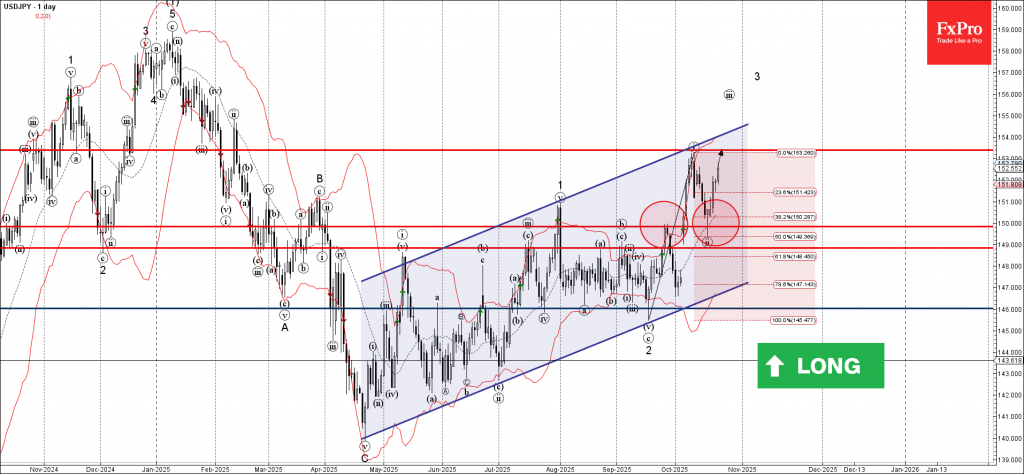

USDJPY: ⬆️ Buy

– USDJPY reversed from support area

– Likely to rise to resistance level 153.40

USDJPY currency pair recently reversed from the support area located between the key support level 150.00 (former monthly high from September) and the 50% Fibonacci correction of the upward impulse from September.

The upward reversal from this support area created the daily Japanese candlesticks reversal pattern Hammer – which started the active impulse wave iii.

Given the clear daily uptrend and strong yen sales, USDJPY currency pair can be expected to rise to the next resistance level 153.40 (top of the impulse wave i from the start of October).