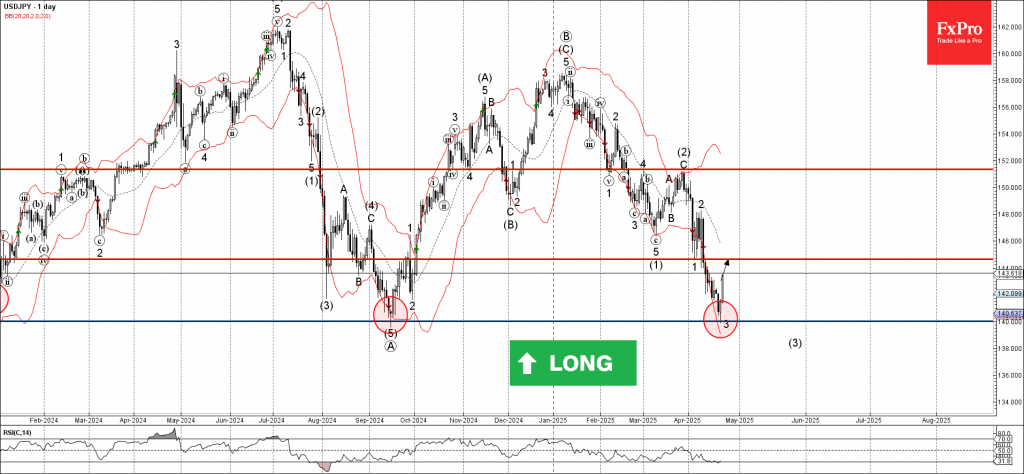

USDJPY: ⬆️ Buy

– USDJPY reversed from the support area

– Likely to rise to the resistance level 144.65

USDJPY currency pair recently reversed up from the support area between the long-term support level 140.00 (former multi-month low from September) and the lower daily Bollinger Band.

The upward reversal from this support area stopped the previous sharp downward impulse wave 3 of the higher impulse wave (3) from February.

Given the strength of the support level 140.00 and the strongly bearish yen sentiment seen today, USDJPY currency pair can be expected to rise toward the next resistance level 144.65 (former support from the start of April).