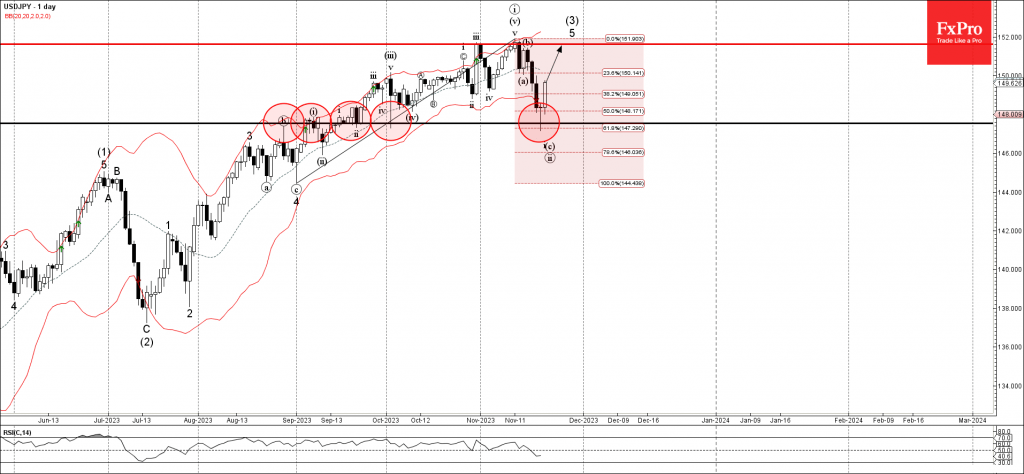

– USDJPY reversed from key support level 147.55

– Likely to rise to resistance level 152.00,

USDJPY currency pair recently reversed up from the key support level 147.55 (which has been supporting the price from September) intersecting with the 61.8% Fibonacci correction of the upward impulse from August.

The upward reversal from the support level 147.55 is currently forming the daily Morning Star candlesticks reversal pattern, which stopped the earlier minor correction ii.

Given the predominant daily uptrend, USDJPY currency pair can be expected to rise further to the next resistance level 152.00, which stopped the previous waves iii and i.