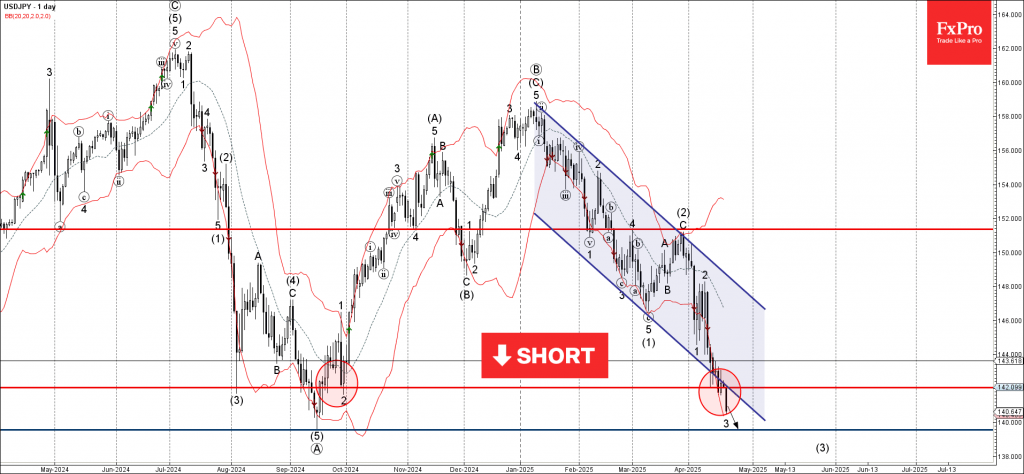

USDJPY: ⬇️ Sell

– USDJPY broke support area

– Likely to fall to support level 139.55

The USDJPY currency pair recently broke the support area at the intersection of the support trendline of the daily down channel from January and the support level 142.00 (which started the daily uptrend in September).

The breakout of this support area should accelerate the active impulse wave 3, which belongs to the intermediate impulse wave (3) from March.

Given the strongly bearish US dollar sentiment, USDJPY currency pair can be expected to fall to the next support level 139.55 (the former multi-month support level from September).