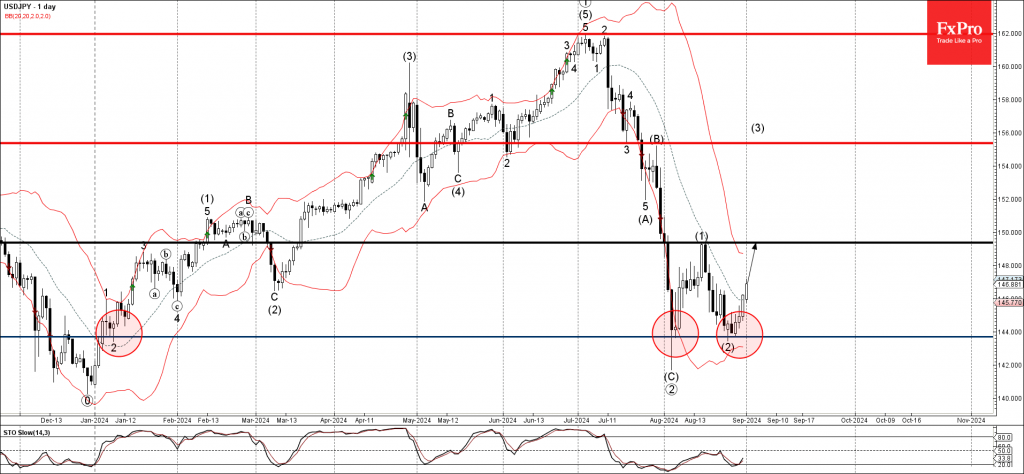

– USDJPY reversed from support level 144.00

– Likely to rise to resistance level 149.35

USDJPY currency pair recently reversed up from the strong support level 144.00 (which has been reversing the price from January) standing near the lower daily Bollinger Band.

The upward reversal from the support level 144.00 created the daily Japanese candlesticks reversal pattern Bullish Engulfing – which started the active impulse wave (3).

Given the strength of the support level 144.00 and the continuation of the yen sales, USDJPY currency pair can then be expected to rise to the next resistance level 149.35 (top of the previous impulse wave (1)).