– USDJPY reversed from support level 137.50

– Likely to rise to resistance level 140.70

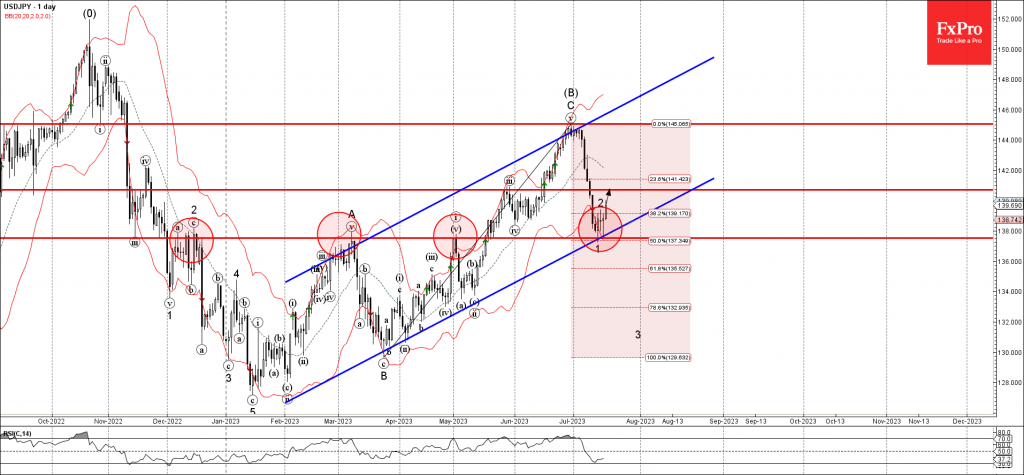

USDJPY currency pair previously reversed up from the key support level 137.50, former monthly high from March and May, strengthened by the lower daily Bollinger Band and by the support trendline of the daily up channel from February.

The upward reversal from the support level 137.50 started the active short-term correction 2.

Given the active mid-term uptrend, USDJPY currency pair can be expected to rise further toward the next resistance level 140.70.