– USDJPY under the bullish pressure

– Likely to rise to resistance level 156.35

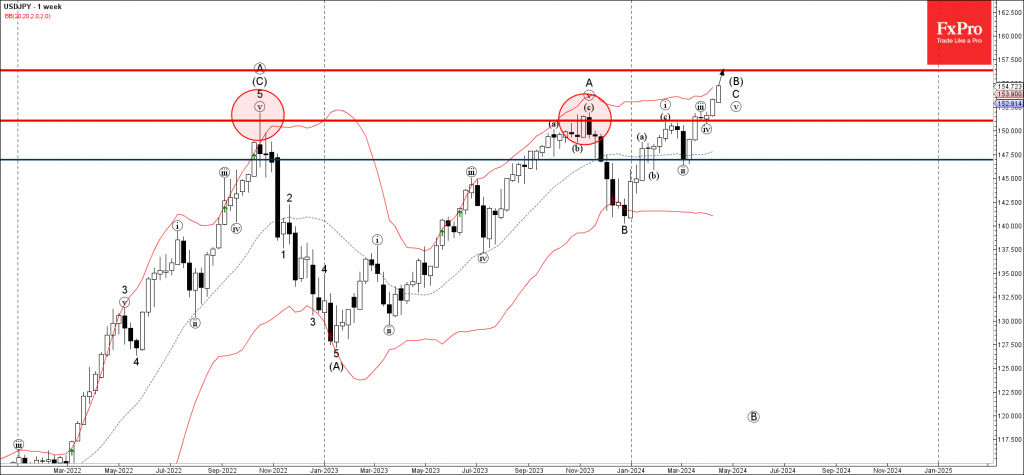

USDJPY currency pair under the bullish pressure after the earlier breakout of the major resistance level 151.80, former yearly high from 2022 and 2023.

The breakout of the resistance level 151.80 accelerated the C-wave of the active ABC correction (B) from the start of last year.

Given the clear multi-month uptrend and continued US dollar strength, USDJPY currency pair can be expected to rise further to the resistance level 156.35 (target price for the completion of the active C-wave).