– USDJPY broke resistance zone

– Likely to rise to resistance level 152.00

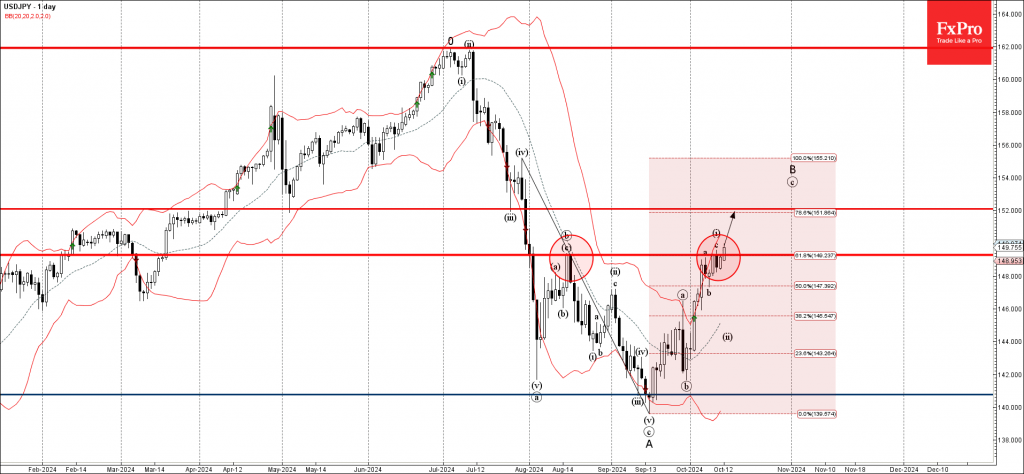

USDJPY currency pair recently broke through resistance zone located between the key resistance level 149.30 (former top of wave b from the middle of August) and the 61.8% Fibonacci correction of the downward impulse wave from July.

The breakout of this resistance zone continues the active short-term impulse sequence (c) of the B-wave from the middle of September.

Given the rising bullish US dollar sentiment, USDJPY currency pair be expected to rise further to the next resistance level 152.00 (which is the former minor support from July).