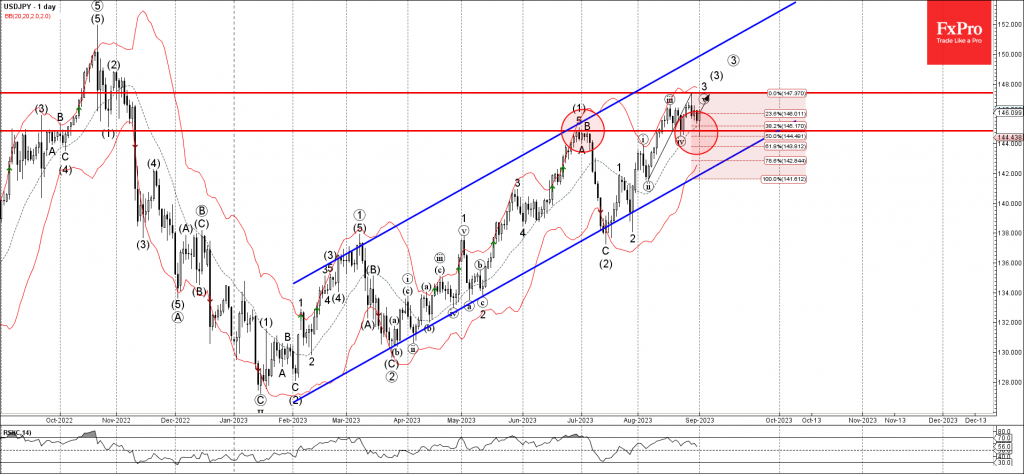

– USDJPY reversed from support level 144.85

– Likely to test resistance level 147.40

USDJPY currency pair recently reversed up from the support level 144.85 (former resistance from the end of June), intersecting with the 50% Fibonacci correction of the upward impulse from the start of August.

The upward reversal from the support level 144.85 continues the active impulse waves 3 and (3).

Given the strong daily uptrend, USDJPY can be expected to rise further toward the next resistance level 147.40 (previous monthly high from August).