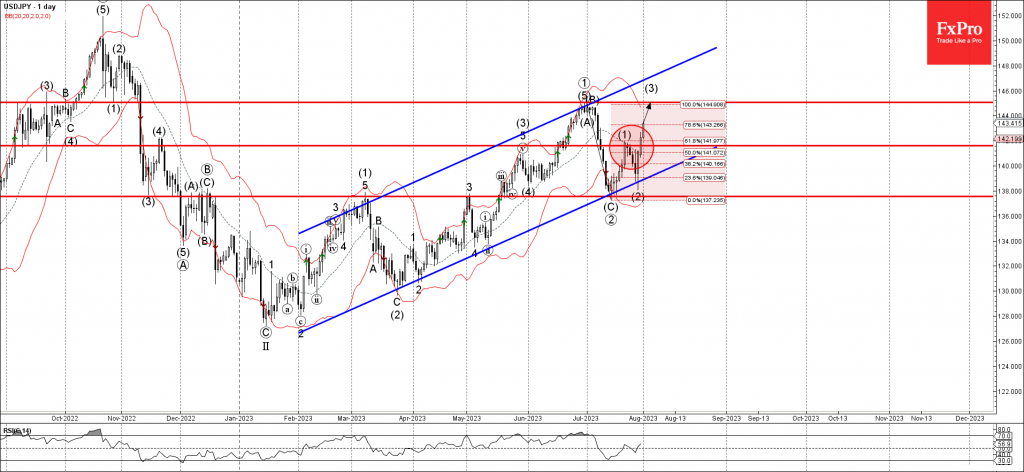

– USDJPY broke resistance level 141.60

– Likely to rise to resistance level 145.00

USDJPY currency pair recently broke the key resistance level 141.60 (top of the previous sharp upward impulse wave (1) from last month).

The breakout of the resistance level 141.60 coincided with the breakout of the 61.8% Fibonacci correction of the previous downward correction from June.

Given the clear daily uptrend, USDJPY currency pair can be expected to rise further toward the next resistance level 145.00 (previous monthly high from June).