– USDCHF reversed from support level 0.8400

– Likely to rise to resistance level 0.8550

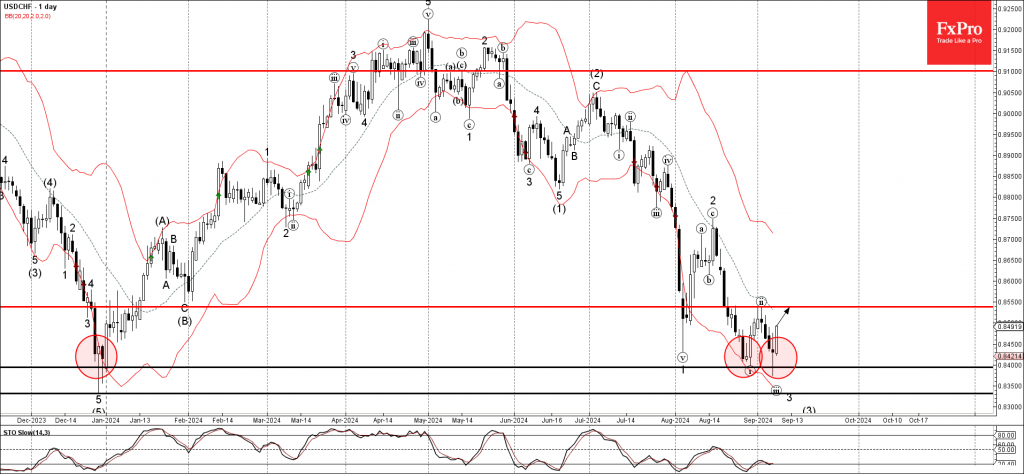

USDCHF currency pair recently reversed up from the key support level 0.8400 (which has been reversing the price since the end of last year).

The upward reversal from the support level 0.8400 created the daily Japanese candlesticks reversal pattern Long-legged Doji.

Given the strength of the support level 0.8400 and the bullish US dollar sentiment seen across the FX markets today, USDCHF currency pair can rise further to the next resistance level 0.8550.