– USDCHF reversed from pivotal resistance level 0.9100

– Likely to fall to support level 0.8940

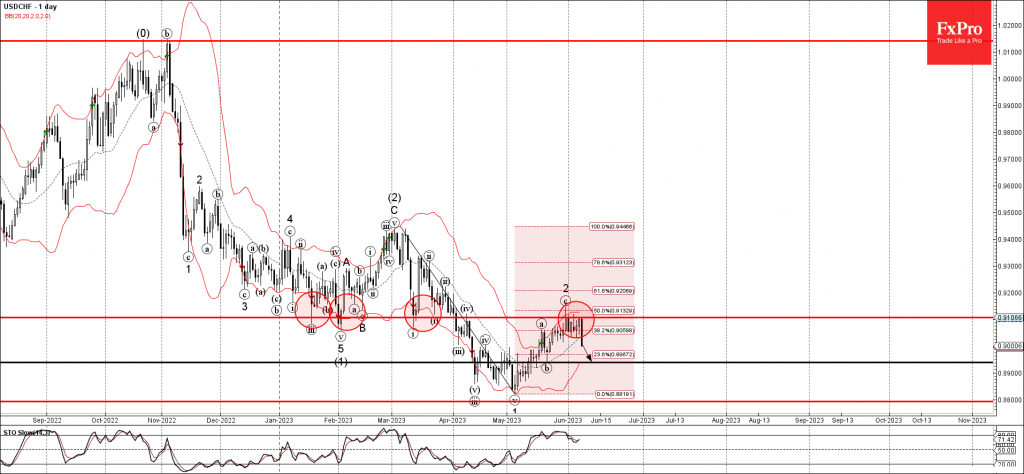

USDCHF recently reversed down sharply from the pivotal resistance level 0.9100 (former strong support from January to March), coinciding with the upper daily Bollinger Band.

The downward reversal from the resistance level 0.9100 continues the active short-term impulse wave 3, which belongs to wave (3) from the start of March.

Given the clear daily downtrend, USDCHF can be expected to fall further toward the next support level 0.8940 (low of the previous minor correction (b)).