• USDCHF reversed from resistance level 0.9070

• Likely to fall to support level 0.9000.

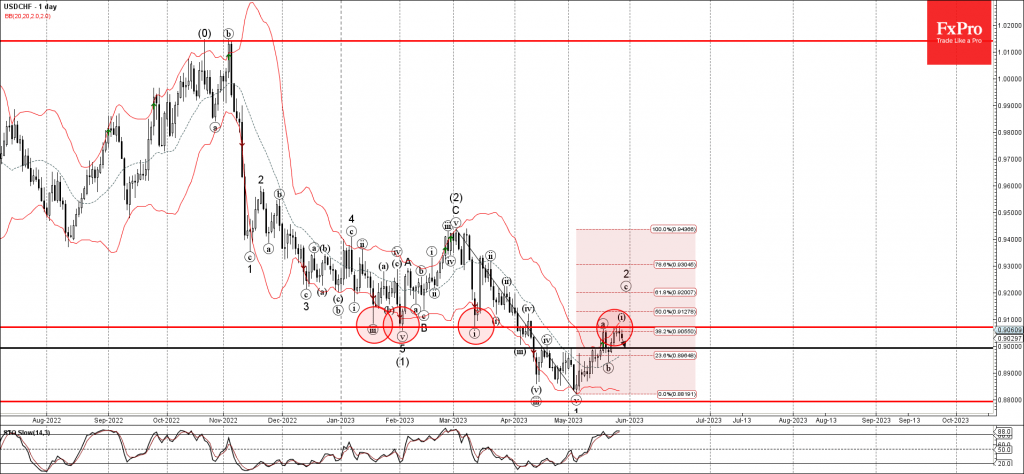

USDCHF currency pair recently reversed down from the pivotal resistance level 0.9070 (former monthly low from January, February and March).

The resistance level 0.9070 was strengthened by the upper daily Bollinger Band and by the 38.2% Fibonacci correction of the downward impulse from the start of March.

Given the overbought daily Stochastic, USDCHF can be expected to fall toward the next round support level 0.9000.