– USDCHF reversed from support zone

– Likely to rise to resistance level 0.9050

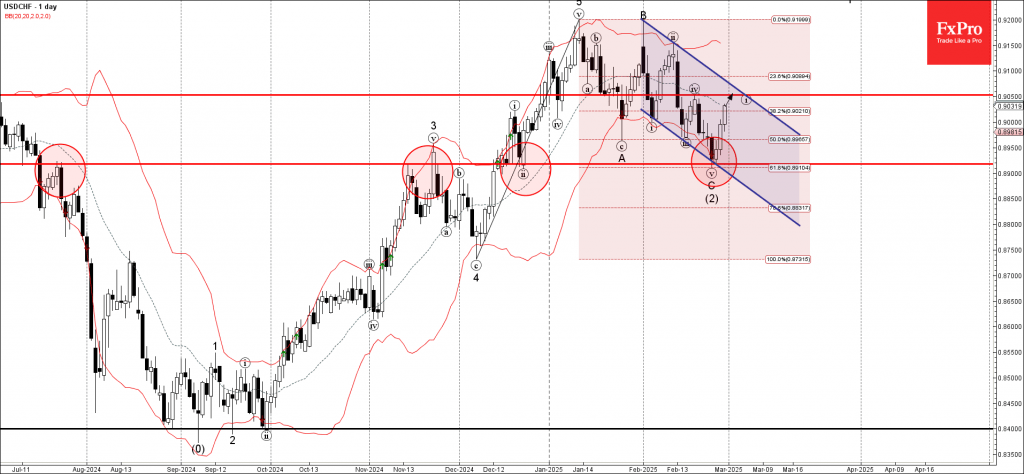

USDCHF currency pair recently reversed from the support zone between the support level 0.8920 (which has been reversing the price from November), support trendline of the daily down channel from January and the lower daily Bollinger Band.

The upward reversal from this support zone created the daily Japanese candlesticks reversal pattern Morning Star which started the active impulse wave (3).

Given the clear daily uptrend, USDCHF can be expected to rise to the next resistance level 0.9050 (top of the previous minor correction iv).