– USDCHF broke resistance level 0.9150

– Likely to rise to resistance level 0.9300

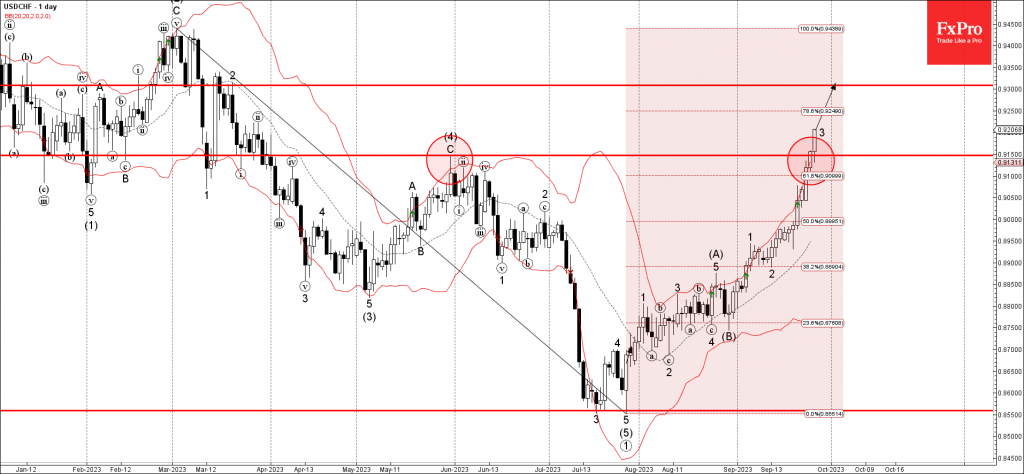

USDCHF currency pair recently broke above the strong resistance level 0.9150 (former multi-month high from May) standing near the 61.8% Fibonacci correction of the previous upward impulse from March.

The breakout of the resistance level 0.9150 was accelerated the active impulse wave 3 of the intermediate impulse wave (C) from the end of August.

USDCHF currency pair can be expected to rise further toward the next resistance level 0.9300 (former top of wave 2 from the middle of March).