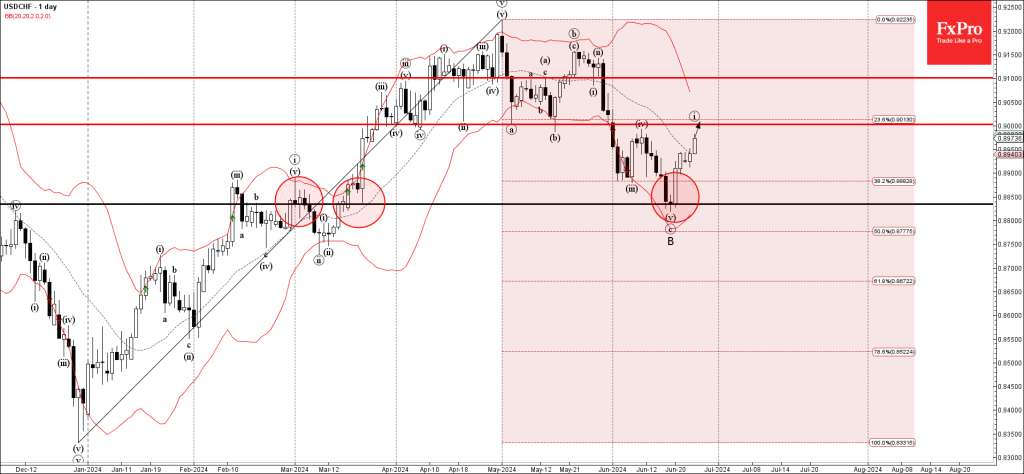

– USDCHF rising inside impulse wave i

– Likely to reach resistance level 0.9000

USDCHF continues to rise inside the minor impulse wave i, which started earlier, when the pair reversed up from the key support level 0.8835, standing near the lower daily Bollinger Band and the 50% Fibonacci correction level of the previous upward impulse from December.

The upward reversal from the support level 0.8835 created the perfectly formed Japanese candlesticks reversal pattern Morning Star.

Given the continuation of the Swiss franc sales and USD bullish sentiment seen today, USDCHF can be expected to rise toward the next round resistance level 0.9000 (former strong support from April and May).