– USDCHF reversed from resistance zone

– Likely to fall to support level 0.8860

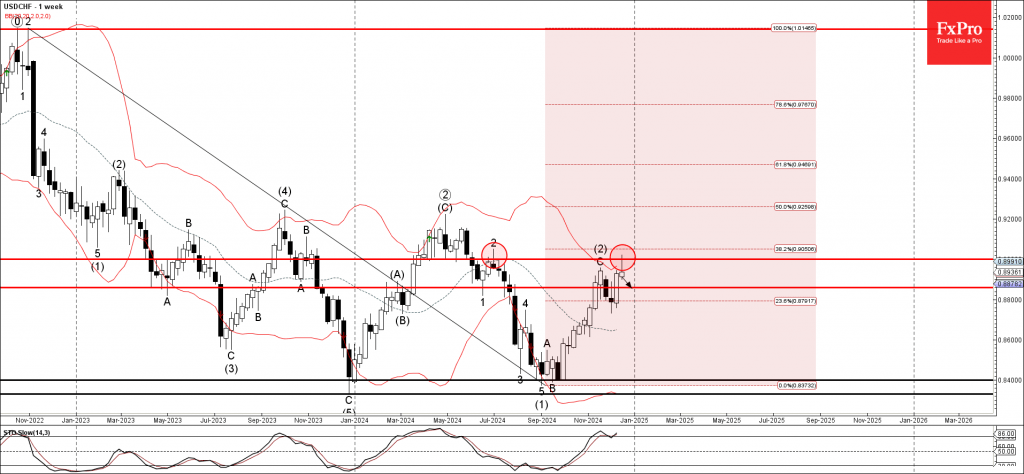

USDCHF currency pair recently reversed down from the strong resistance zone located between the round resistance level 0.90000 (which has been reversing the pair from the idle of last year) and the upper weekly Bollinger Band.

The resistance level 0.90000 was further strengthened by the 38.2% Fibonacci correction of the weekly downtrend from the end of 2022.

Given the strong multiyear downtrend and the overbought weekly Stochastic, USDCHF currency pair can be expected to fall to the next support level 0.8860.