– USDCHF reversed from resistance area

– Likely to fall to support level 0.8500

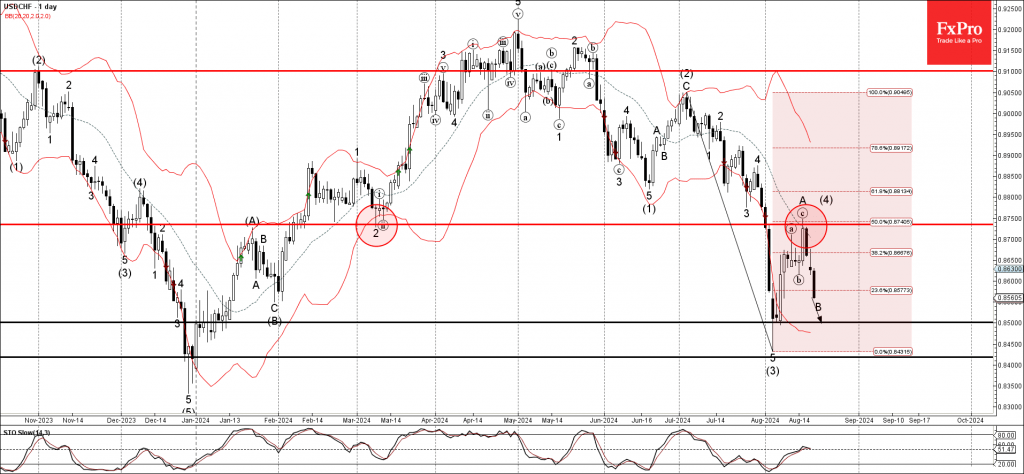

USDCHF currency pair recently reversed down from the resistance area set between the resistance level 0.8735 (former monthly low from March), 20-day moving average and the 50% Fibonacci correction of the downward impulse from the start of July.

The downward reversal from this resistance area started the active minor corrective wave B, which belongs to the ABC correction (4).

Given the widespread US dollar sales and multi-month downtrend, USDCHF currency pair can be expected to fall further toward the next support level 0.8500 (target for the completion of the active wave B).