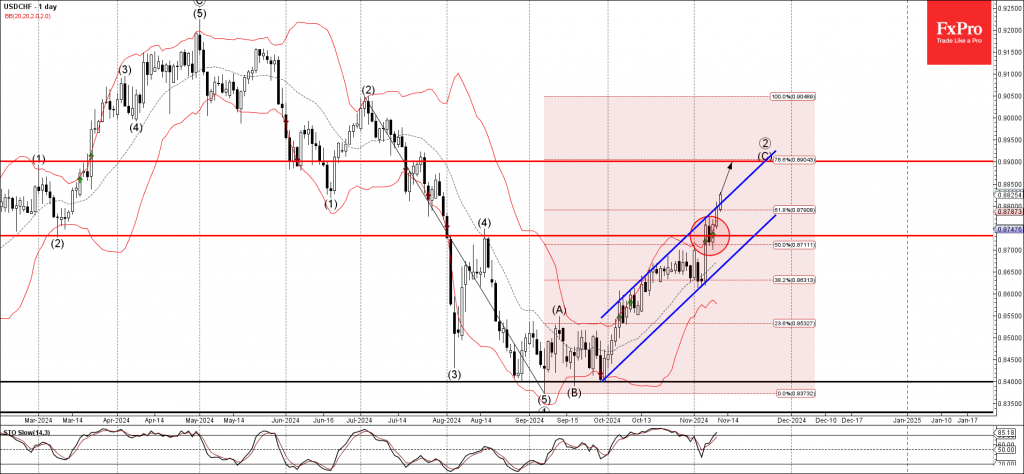

– USDCHF rising inside impulse wave (C)

– Likely to reach resistance level 0.8900

USDCHF currency pair continues to rise inside the medium-term impulse wave (C), which previously broke the resistance level 0.8730 coinciding with the 50% Fibonacci correction of the downward impulse from July.

The active impulse wave (C) belongs to the longer-term upward impulse sequence (2) from the start of September.

USDCHF currency pair can be expected to rise to the next resistance level 0.8900 (target price for the completion of the active impulse wave (C)).