– USDCHF broke resistance zone

– Likely to rise to resistance level 0.8730

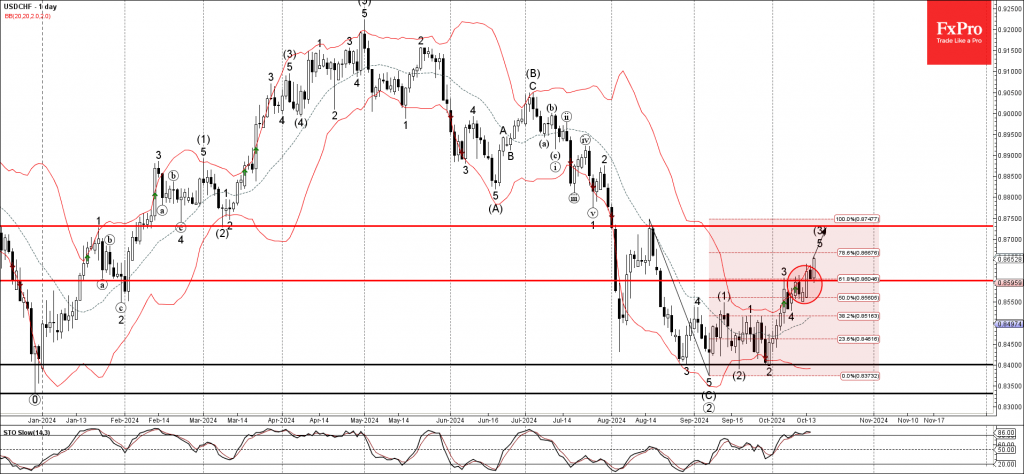

USDCHF currency pair recently broke the resistance zone between the resistance level 0.8600 (which stopped the previous impulse wave 3) and the 61.8% Fibonacci correction of the downward impulse from August.

The breakout of this resistance zone accelerated the minor impulse wave 5 of the higher order impulse wave (3) from September.

Given the continuation of the bullish US dollar sentiment, coupled with significant Swiss franc outflows, USDCHF currency pair can be expected to rise further to the next resistance level 0.8730 (former monthly high from August).