– USDCAD reversed from long-term resistance level 1.3900

– Likely to fall to support level 1.3700

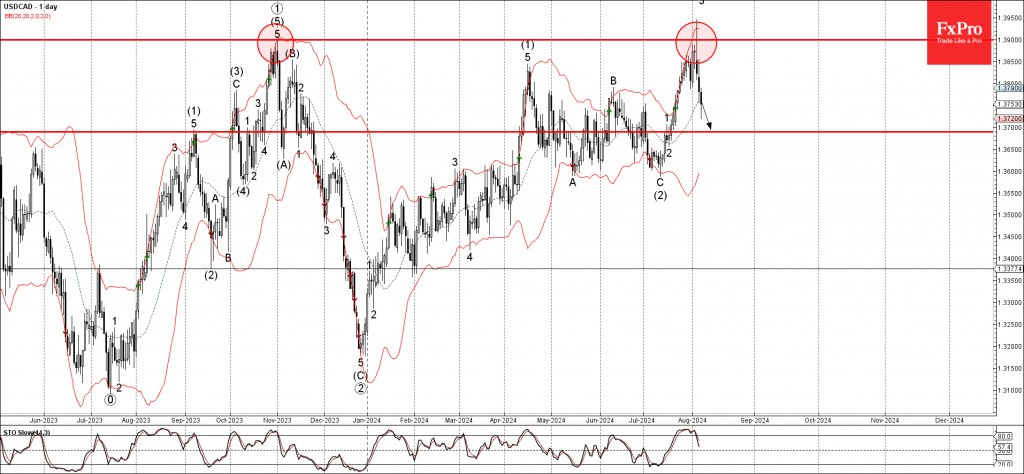

USDCAD currency pair recently reversed down from the resistance zone located between the long-term resistance level 1.3900 (which stopped the weekly uptrend at the end of 2023) and the upper weekly Bollinger Band.

The downward reversal from the resistance zone created the weekly candlesticks reversal pattern Shooting Star Doji.

Given the strength of the resistance level 1.3900, USDCAD currency pair can be expected to fall further toward the next support level 1.3700.