– USDCAD reversed from key support level 1.3200

– Likely to rise to resistance level 1.3400

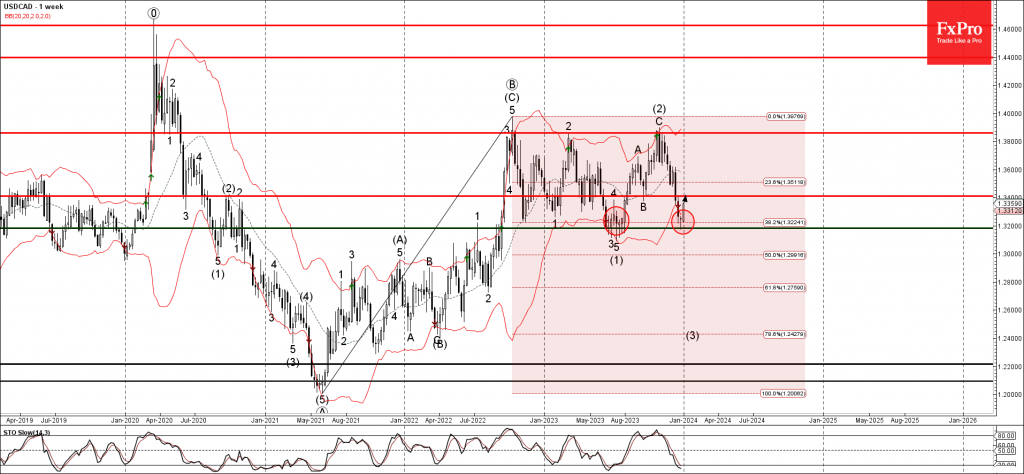

USDCAD currency pair recently reversed up from the key support level 1.3200 (which reversed the price multiples times in the middle of 2023, as can be seen below).

The support level 1.3200 was further strengthened by the lower daily Bollinger Band and by the 38.2% Fibonacci correction of the upward impulse from 2021.

Given the strongly bullish dollar sentiment seen today, USDCAD can be expected to rise further to the next resistance level 1.3400 (former low of wave B from last year).