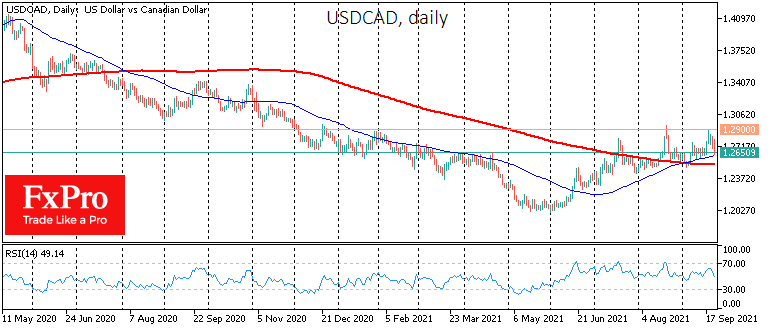

USDCAD is losing around 1% on Thursday, pulling back to 1.2640. The pair faced significant resistance on the approach to 1.2900 at the start of the week, but bears stopped the pair from moving higher since last December.

USDCAD has been in an upward trend since June but sees heavy sales near 1.2900. This might be a signal that American investors are not rushing to buy USD against the commodity currencies.

Today’s macro statistics also favoured CAD against USD as Canadian retail sales declined less than expected against the second week of rising jobless claims in the US. However, today’s decline in USDCAD came before these publications.

The trend indicators, 50 and 200 SMAs are passing through 1.2615 and 1.2520. A decisive break-up of these levels can increase the pressure in the pair, but the chances are high that the bulls have not yet put up a final fight.

The FxPro Analyst Team