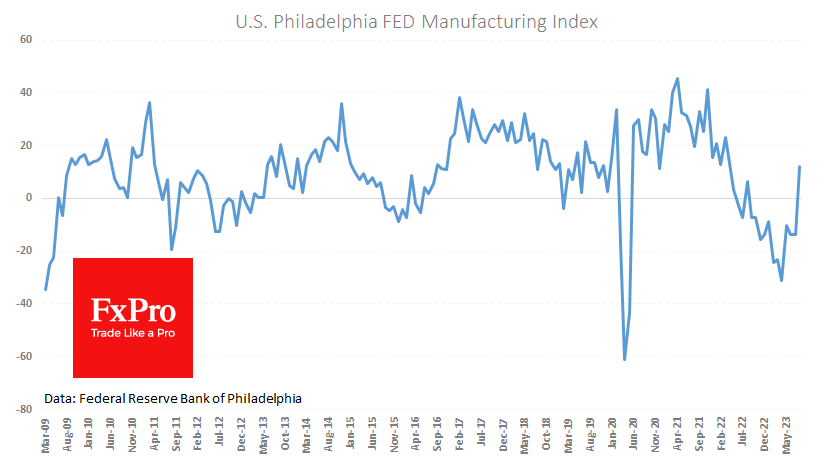

The US manufacturing sector is showing impressive expansion. The latest data from the Philadelphia Fed Manufacturing Business Outlook Index jumped from -13.5 to +12.0 in August, against forecasts of -9.8. This is the first time since August last year that the index has been in positive territory, and even with such a significant jump, it reinforces the positive signals from the Fed’s publications the day before.

On Wednesday, the Fed reported that industrial production grew by 1% versus expectations of 0.3%. Today’s Philly Fed estimates point to even more robust growth in August.

The night before, markets were unarmed by the FOMC minutes, which highlighted inflationary risks, while the media prepared us for a softer stance on interest rates.

Upbeat macro reports recently have boosted expectations of a Fed Funds rate hike on 1 November. The probability of this outcome is now estimated at 41%, up from 31% a week ago.

Theoretically, this is good news for the dollar and bad news for the stock market and other risky assets. In practice, the market is in no hurry to panic, with the S&P500 down over 4% since the start of the month and the Dollar Index down 0.3% since the beginning of the day after seven sessions of gains.

The FxPro Analyst Team