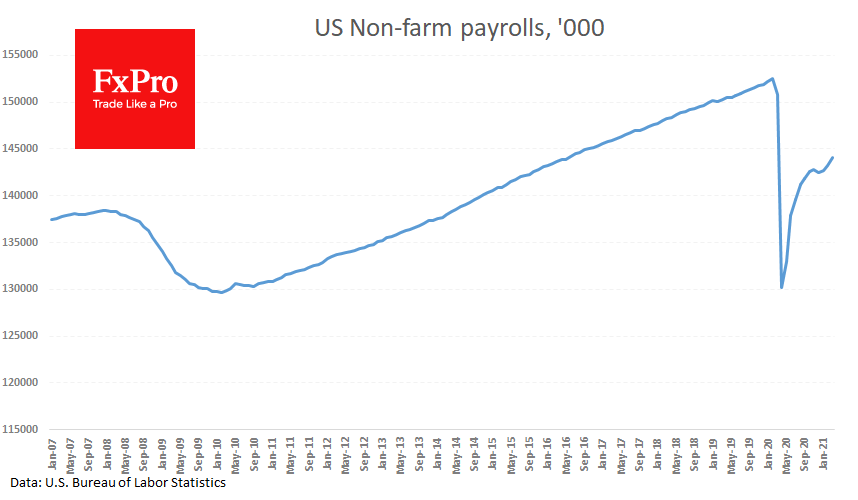

Employment in the USA rose by 916,000, better than the average forecast of 650,000.

An additional positive signal from the labour market is that the average working week rose to 34.9 hours, a repeat of the highs of January and the highest values in the indicator’s history since 2006. This data reflects a high workload, suggesting a further healthy rate of employment growth.

Against the backdrop of booming employment and workload, it should not be surprising to see wages fall: employers are bringing back less qualified workers, which is pulling the averages down.

This strong macro data has pushed S&P500 futures to new all-time highs (the stock market itself is closed today). The first reaction of the dollar is mixed.

Generally speaking, strong employment growth is a positive for the US currency, as it promises higher inflation and an earlier rate hike. But that is still too far away, making the dollar attractive as a funding currency for buying stocks and commodities.

The FxPro Analyst Team