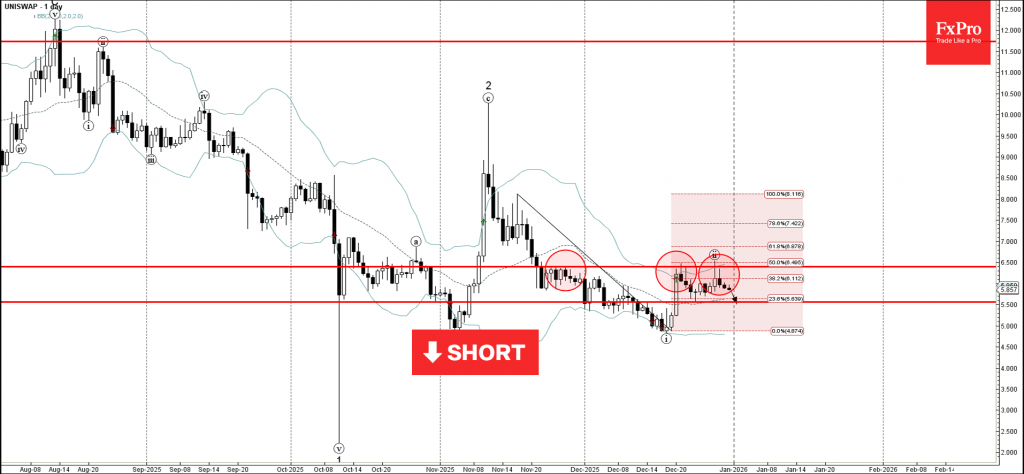

Uniswap: ⬇️ Sell

– Uniswap reversed from resistance area

– Likely to fall to support level 5.500

Uniswap cryptocurrency recently reversed from the resistance area between the key resistance level 6.5 (which has been reversing the Uniswap from the end of November), upper daily Bollinger Band and the 50% Fibonacci correction of the downward impulse from November.

The downward reversal from this resistance area created the daily Shooting Star – which started the active impulse wave 3.

Given the clear daily downtrend, Uniswap cryptocurrency be expected to fall to the next strong support level 5.500 (low of the previous minor correction).